457 withdrawal calculator

To retire is to withdraw from active working life and for most retirees retirement lasts the rest of their lives. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

457 Retirement Plan Explained Youtube

Annual contribution limits Your total contribution for one year is based on your annual salary times the percent you contribute.

. Required Minimum Distribution Calculator. Build Your Future With a Firm that has 85 Years of Investment Experience. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Ad Unlock Your Access To Essential Financial Planning Tools Get Appointed Today. 457 Plan Withdrawal Calculator 457 Plan Withdrawal Calculator Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation.

This calculator limits your contribution to 50 of your salary. This is a very. Jacksons Assessment Tools Can Help Kickstart A More Meaningful Conversation With Clients.

457 Plan Withdrawal Calculator Definitions Amount to withdraw The amount you wish to withdraw from your qualified retirement plan. The goal of a retirement withdrawal calculator is to figure out how much you withdraw from savings without running out of money before you run out of life. Ad Once You Retire You Wont Pay Taxes When You Withdraw Your Money.

Annual contribution limits Your total contribution for one year is based on your annual salary times the percent you contribute. It is designed to help you work out how much tax you will pay on any funds you take from the account. Unlike 403 b and 401 k accounts participants can take regular withdrawals from 457 plans as soon as they retire regardless of whether they have reached age 59½.

Build Your Future With a Firm that has 85 Years of Investment Experience. Use this calculator to determine how long those funds will last given regular withdrawals. Withdrawals are subject to.

457 Plan Withdrawal Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. While it is most frequently used to calculate how long an investment will last assuming some. The Sooner You Invest the More Opportunity Your Money Has To Grow.

Retirement Withdrawal Calculator Use this calculator to help you manage withdrawals from your defined contribution accounts that you have set aside for retirement. The Sooner You Invest the More Opportunity Your Money Has To Grow. Use this calculator to see what your net.

Current savings balance Proposed. Withdrawals are subject to income tax. Withdrawing 1000 leaves you with 710 after taxes Definitions Amount to withdraw The amount you wish to withdraw from your qualified retirement plan.

Our Retirement Calculator can help by considering inflation in several. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Not an easy task.

Annual contribution limits Your total contribution for one year is based on your annual salary times the percent you. You will find the savings withdrawal calculator to be very flexible. Open an IRA Account.

See how increasing your 457 Plan contributions can provide a valuable boost to your future savings. The 457 withdrawal calculator is very easy to use. 457 plan withdrawal calculator Minggu 11 September 2022 When saving for retirement your employer may give you a hand by offering a tax-advantaged savings planYour.

You have worked hard to accumulate your savings. The system only works with. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. This calculator limits your contribution to 50 of your salary. This calculator limits your contribution to 50 of your salary.

Open an IRA Account. Ad Once You Retire You Wont Pay Taxes When You Withdraw Your Money. 457 Plan Withdrawal Calculator 457 Plan Withdrawal Calculator Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation.

A Checklist For Drafting Section 457 F Plans For Tax Exempt Employers

Can I Max Out My 401k And 457 Here S How It Works

457 Contribution Limits For 2022 Kiplinger

Tax Benefits Of 403 B And 457 Plans

How To Utilize Your Non Governmental 457 B Plan White Coat Investor

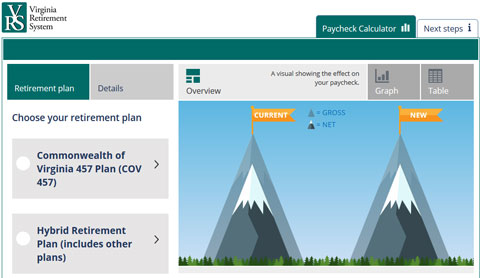

Vrs Contributions

457 Plan Types Of 457 Plan Advantages And Disadvantages

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

Can I Max Out My 401k And 457 Here S How It Works

Peraplus 401 K 457 Overview You Ll Never Regret Having More Money In Retirement The Voluntary Peraplus 401 K And 457 Plans Give You Additional Options For Saving For Your Future By Colorado Pera Facebook

403 B Vs 457 B What S The Difference Smartasset

401 K Vs 403 B Vs 457 Plans Compare Employer Sponsored Retirement Plans Mybanktracker

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

457 Retirement Plans Their One Big Advantage Over Iras Money

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

A Guide To 457 B Retirement Plans Smartasset

457 Vs Roth Ira What You Should Know 2022